- The information on the website is for reference only. Please verify with the relevant airline/agency/facility for accurate information.

Filling Out the Customs Declaration Form

- Travelers with items to declare should complete the customs declaration form and use the “Goods to Declare” lane for customs inspection.

- If you are entering the country with your family, only one form is needed per family.

- Fill out the customs declaration form given onboard, including the items to declare and personal details, and sign it.

- You may choose to complete the customs declaration form in the arrival hall; however for a quicker entry process, it is recommended to fill it out in advance while on the plane.

- If you have separately sent items or unchecked baggage, note them on the declaration form and submit it to the customs officer at the arrival location for verification.

- If you wish to pay taxes later, you should ask the customs officer.

- Mobile Customs Declaration: You can complete the customs declaration via the “Traveler Customs Declaration” app or website during entry, which allows for a faster and more convenient entry process. (Taxes are also payable after the declaration) Go to Link

Hand-carried Items Declaration Form

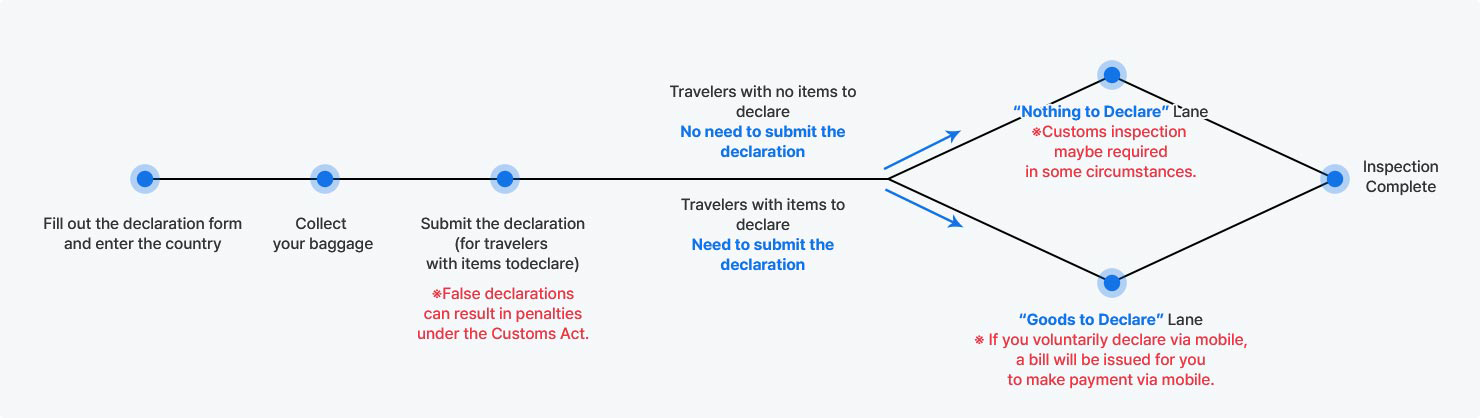

Customs Inspection Procedures

Traveler’s Duty-Free Allowance for Hand-carried Items

| Category | Description | Remarks |

|---|---|---|

| Duty-free Allowance | USD 800 | |

| Prohibited Items (Not Permitted for Customs Clearance) |

|

|

| Separate duty-free Items |

|

|

| Duty-free Allowance for Agricultural, Forestry, Livestock Products (Medicinal Herbs) |

|

|

Assistance available for voluntary declarations

- Considering the purpose of the traveler’s trip, duration, quantity, and value of items, if there is no particular suspicion, items will be cleared rapidly without physical inspection.

- If any prohibited or restricted items are found among the goods you brought in, they will be inspected, and all necessary conditions will be assessed.

- The declared value will be accepted unless it is unusually low, and taxes will only be imposed if the value exceeds the duty-free allowance.

- If the customs officer deems the traveler’s identity to be reliable, deferred tax payment may be allowed.

Notice

- Please note that if you falsely complete the customs declaration or fail to declare items and are caught in the duty-free lane, you may face penalties (confiscation of goods, fines, imprisonment) under the Customs Act.

- Please be aware that bringing in items on behalf of someone else may be illegal. If the items include prohibited or restricted goods, you will be held fully responsible and liable for any resulting penalties.

- If you must bring in items on behalf of someone else, you must declare them on the customs declaration form or verbally inform a customs officer to avoid liability.

Inquiries

- Contact: T1 Traveler Customs Clearance Division 1 (032-722-4422) / T2 Traveler Customs Clearance Division 2 (032-723-5119)

![관세청 KOREA CUSTOMS SERVICE 여행자 휴대품 신고서 신고대상물품이 있는 입국자는 신고서를 작성·제출해야 합니다. 동일한 세대의 가족은 1명이 대표로 신고할 수 있습니다. 성명과 생년월일은 여권과 동일하게 기재해야 합니다. 성명 생년월일 년 월 일 여권번호 외국인데 한함 여행기간 일 출발국가 동반가족 본인외 명 항공편명 전화번호 국내 주소 세관 신고사항 해당 사항에 v 표시 1.휴대품 면제범위(뒷면 참조)를 초과하는 품목 물품 상세 내역은 뒷면에 기재 자진신고 시 관세의 30#(20만원 한도) 감면 면세 초과 있음 술 담배 향수 일반물품 없음 2 원산지가 FTA 협정국가인 물품으로서 협정관세르 적용받으려는 물폼 있음 없음 3 미화로 환산해서 총합계가 1만 달러를 초과하는 화폐 등 (현금, 수표, 유가증권 등 모두 합산) 있음 없음 [총 금액: ] 4 우리나라로 반입이 금지되거나 제한되는 물품 1.총로퓨, 실탄, 도검류, 마약류, 방사능 물질 등 2. 위조지폐, 가짜 상품 등 3.음란물, 북한 찬양 물품, 도청 장비 등 ㄹ. 멸종위기 동식물 (앵무새, 도마뱀, 원숭이, 난초 등) 또는 관련 제품 (웅담, 사향, 악어가죽 등) 5 동·식물 등 검역을 받아야 하는 물품 있음 없음 ㄱ.동물(물고기 등 수생 동물 포함) 2.축산물 및 축산가공품 (육포, 햄, 소시지, 치즈 등) ㄷ.식물, 과일류, 채소류, 견과류, 종자, 흙 등 - 가축전염병 발생국의 축산농가 방문자는 농림축산검역본부에 신고하시기 바랍니다. 6 ㅅ관릐 확인을 받아야 하는 물품 있음 없음 ㄱ.판매용 물품, 회사에서 사용하는 견본품 등 ㄴ.다른 사람의 부탁으로 반입한 물품 ㄷ.세관에 보관 후 출국할 때 가지고 갈 물품 ㄹ.한국에서 잠시 사용 후 다시 외국으로 가지고 갈 물품 ㅁ.별송품, 출국할 때 일시수출(반출)신고를 한 물품등 본인은 이 신고서를 사실대로 성실하게 작성하였습니다. 년 월 일 신고인 : (서멸) <뒷면에 계속> 1인당 '품목'별(술/담배/향수/일반물품) 면제범위 * 해외 또는 국내 면세점에서 구매하거나, 기능 또는 선물받은 물품 등으로서 술 2병 합산 2리터 이하로서 총 US 400달러 이하 담배 - 권련형 : 200개피(10갑) - 시가: 50개비, 액상: 30ml(니코틴 함량 1% 이상은 반입 제한) - 한종류만 선택 가능 향수 : 100ml 일반물품 미화 800달러 이하 - 다만, 농림축수산물 및 한약제는 검역에 합격한 것으로서 총 40kg, 총 금액 10만원 이하 (물품별로 수량,중량 제항) * 만 19세 미만인 사람(만 19세가 되는 해의 1월 1일을 맞이한 사람은 제외)에게는 술 및 담배를 면세하지 않습니다. 면세범위 초과 품목의 상세내역 - 면세범위 이내 품목 - 작성 생략 - 면세범위 초과 품목 - 해당 품목의 전체 반입내역 작성 예 시 : 술3병, 담배 10갑, 향수 30ml, 시계(가격 1천 달러) 반입시 -> 술 3병, 시계(가격 1천 달러) 작성 (면세범위 이내인 담배, 향수는 작성 생략) 품목, 물품명, 수량(또는 중량), 금액, 술, 담배, 향수, 일반물품, * 세관 신고사항을 신고하지 않거나 허위신고한 경우 가산세 (납부세액의 40% 또는 50%)가 추가 부과되거나, 5년 이하의 징역 또는 벌금(해당 물품은 몰수) 등의 불이익을 받게 됩니다. 90mmx245mm(백상지 100g/m2)](/sites/ap_en/images/sub/carry-on-img.png)